Growing Together

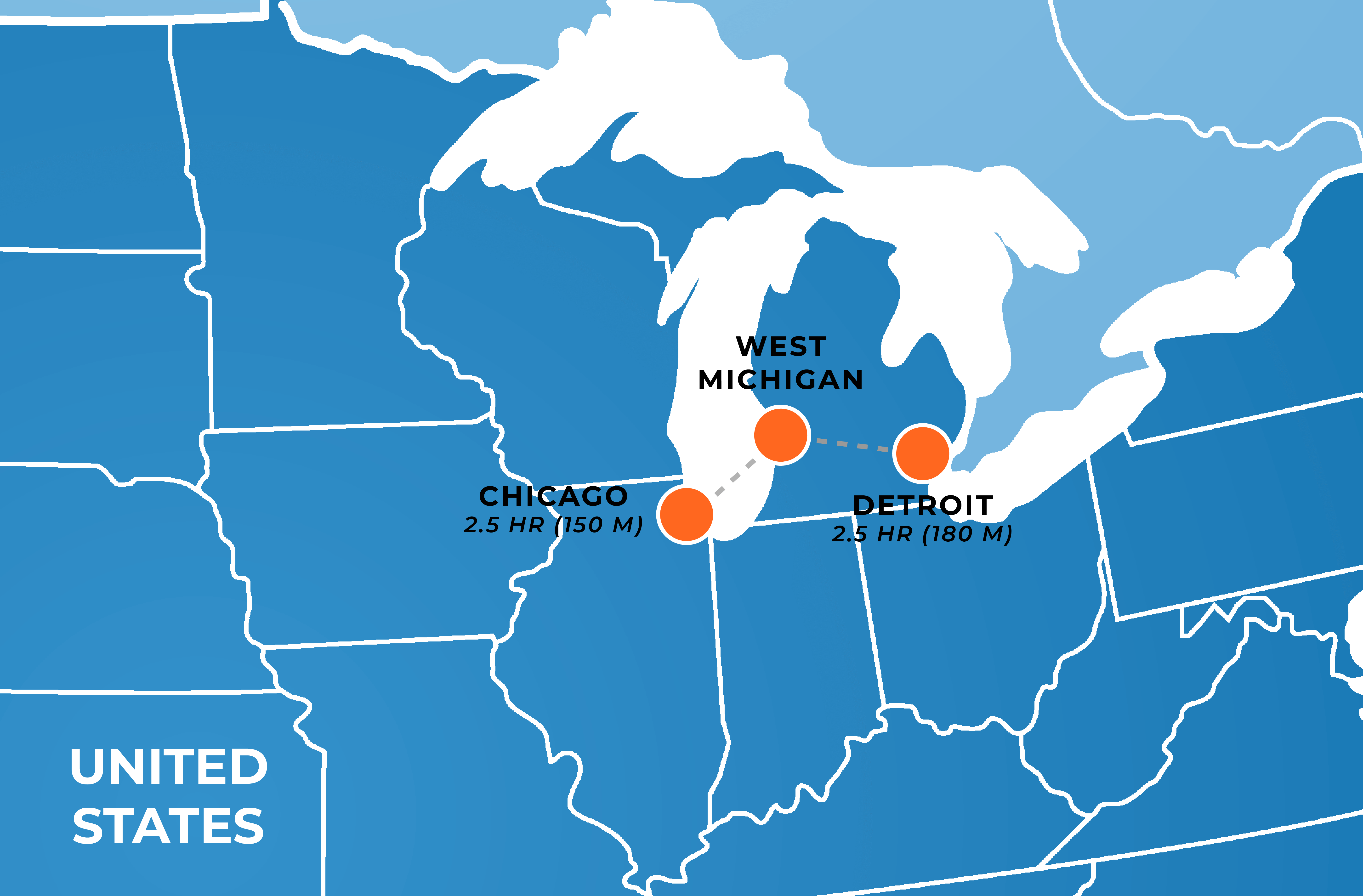

Between the shores of Lake Michigan and the heart of the auto industry, West Michigan is a place where community and business grow together.

Michigan’s Automotive Industry

Michigan has the greatest concentration of mechanical and industrial engineers in the U.S.

Michigan ranks 3rd in the nation for foreign direct investment projects.

Why Do Business Here?

“If you’re looking to be part of the design, engineering, manufacturing, and integration of advanced energy storage solutions, Michigan is the place to be, for where these industries are growing, where you can get connected to resources, where you can be part of creating a clean energy future.”

– Michael DiRamio, Corporation for a Skilled Workforce

Advanced Energy Storage Expertise

Engineering and Supply Chain Talent

Michigan is home to the highest density of engineers in the nation, with over 123,000 electrical, mechanical and industrial engineers statewide.

Read More +

West Michigan is a solid and growing advanced energy storage industry hub. Our supply chain is strong with many advanced energy storage suppliers, manufacturers, and transportation logistics companies. West Michigan’s rich advanced energy storage resources and knowledge offer a competitive advantage.

#RechargeYourFuture Employment Success

We have the talent for your company to succeed here. LG Chem Michigan has built a strong employment brand with their #RechargeYourFuture messaging. West Michigan residents know LG Chem Michigan for its commitment to the environment and opportunities for career growth. The company has grown to over 700 employees in Holland, MI. As a supplier to this Korean company with a local presence, your company can expect to be received with similar enthusiasm as an automotive company charging the industry’s future.

Advanced Energy Storage Innovation Present in Startup Community

Ranked as the best small city to start a business, many advanced energy entrepreneurs have launched companies in Holland.

Jolt Energy is within the Michigan State University Bioeconomy Institute, our chemical engineering research facility. Jolt produces a specialized compound designed to protect lithium-ion cells from overcharge for the lifetime of the battery.

Volta Power Systems designs and builds complete lithium-ion energy systems for any mobile application. The systems grant their clients access to advanced energy storage solutions without the cost of research and development.

Global Battery Solutions repairs and re-manufactures lithium-ion batteries, including battery sources for pure electric and plug-in hybrid vehicles.

Vibrant Culture

Read More +

In addition to hosting the Meijer LGPA Classic, West Michigan is home to several championship-winning sports teams, including the Grand Rapids Griffins, West Michigan Whitecaps, Grand Rapids Football Club (GRFC), and the Grand Rapids Drive. West Michigan is home to 24 youth baseball leagues and is within a 3-hour drive of the Detroit Tigers, the Chicago White Sox, and the Chicago Cubs.

Ranked as one of the best places to start a business, live, work, and retire in the nation, we foster a community that makes the human life healthier and richer. West Michigan ranks top for philanthropy and has over two thousand acres of parks, trails, award-winning golf courses and skiing, and several award-winning beaches. We are home to art galleries and sculpture parks with outdoor concert venues such as Meijer Gardens and indoor venues of all sizes, and we are a regular draw for Broadway theater productions. From work to play, West Michigan is at the top of the list.

Power & Infrastructure

Read More +

From the world’s largest snowmelt system, that keeps our downtown streets and sidewalks safe and dry in winter, to fiber broadband internet, offering ten-times faster upload and download speeds, HBPW shows their dedication to preparing our community for the future.

HPBW recently completed Holland Energy Park, the world’s first power plant to earn the Envision Award for sustainable infrastructure. Holland Energy Park features the latest combined-cycle natural gas technology to meet the demands of our growing businesses now and for years to come.

Great Incentive & Tax Structure

Read More +

Transportation & Logistics

How We Stack Up

| Holland, MI MSA | Ottawa County, MI | State of Michigan | |

|---|---|---|---|

| Population Estimate (2020) | 118,999 | 294,830 | 10,001,306 |

| High school graduate or higher (percent of persons age 25+ years, 2012-2016) |

89.5% | 92.2% | 89.9% |

| Bachelor’s degree or higher (percent of persons age 25 years+, 2012-2016) |

22.1% | 32.8% | 28.1% |

| Manufacturing Employment (as a percentage) | 30.7% | 30.4% | 13.2% |

| Reported Annual Violent Crimes / 1,000 | 1.84 | 2.53 | 4.21 |

Our Investment

Lakeshore Advantage is your concierge in securing a West Michigan business location, connecting you with whatever resources are needed to succeed here. Our schools and tech centers are highly connected to our employers, aware of competencies and skills local companies are looking for in their next hires. We will help you navigate the state and local incentives to make your investment in West Michigan a great decision for you.

First

Best Small City to Start a Business

WalletHub

2016-2019

Second

Impulcity

THIRD

Livability

Top five

Forbes Magazine

Second

Gallup-Healthways Well-Being Index

Incentive Programs

West Michigan knows how to ensure innovative companies thrive. Our state corporate tax rate is 6%. The State of Michigan, the City of Holland, Holland Board of Public Works and workforce training support resources including Grand Rapids Community College and West Michigan Works! understand each employers needs and ready the workforce with skills and training needed for the job.

| Community Development Block Grant (CDBG) | A federal grant program that offsets the costs related to the purchase of machinery and equipment. |

| Industrial Property Tax Abatement (PA 198) | Local financing tool that decreases real property taxes by 50% for up to 12 years. |

| Jobs Ready Michigan Program | State grant assistance for talent recruitment and job training in high-impact occupations. |

| Michigan Business Development Program | State grant assistance for the creation of qualified new jobs or investment. |

| New Markets Tax Credits (NMTC) | A federal tax credit that subsidizes building or equipment purchase/construction. |

| Personal Property Tax Reform | Exemption of personal property taxes on property used for industrial processing or related activities. |

| Brownfield Tax Increment Financing | Allows eligible brownfield projects to utilize certain state and local property taxes (including school taxes) to pay for costs related to brownfield site redevelopment.> |

About West Michigan

Natural beauty. Wonderfully livable communities. Smart workers with a can-do attitude. We design, engineer and make the next big advancements in automation, automotive, advanced energy storage and office furniture here.

Sights of West Michigan

Our Region at a Glance

413,829 Population

37 Median Age

22.2 Minute Average Commute

26.2% Manufacturing Employment

144,223 Households

158,404 Housing Units

$168,350 Median House Value

91% High School Graduation or Higher

29.6% Bachelor’s Degree or Higher

Project Information

Wage

Minimum Hourly Wage Rate – Employees must be paid at least:

Effective Date Minimum Hourly Wage Rate

January 1, 2020* $9.65

January 1, 2021* $9.87

*An increase in the minimum hourly wage rate as prescribed in subsection (1) does not take effect if the unemployment rate for this state, as determined by the Bureau of Labor Statistics, United States Department of Labor, is 8.5% or greater for the calendar year preceding the calendar year of the prescribed increase. An increase in the minimum hourly wage rate as prescribed in subsection (1) that does not take effect pursuant to this subsection takes effect in the first calendar year following a calendar year for which the unemployment rate for this state, as determined by the Bureau of Labor Statistics, United States Department of Labor, is less than 8.5%.

Overtime – Employees covered by the Improved Workforce Opportunity Wage Act (IWOWA), Public Act 337 of 2018 must be paid 1-1/2 times their regular rate of pay for hours worked over 40 in a 7-day workweek. The following are exempt from overtime requirements: employees exempt from the minimum wage provisions of the Fair Labor Standards Act of 1938, 29 USC 201 to 219 (except certain domestic service employees), professional, administrative, or executive employees; elected officials and political appointees; employees of amusement and recreational establishments operating less than 7 months of the year; agricultural employees, and any employee not subject to the minimum wage provisions of the act.

Compensatory Time – If an employer meets certain conditions, employees may agree to receive compensatory time of 1-1/2 hours for each hour of overtime worked. The agreement must be voluntary, in writing, and obtained before the compensatory time is earned. All compensatory time earned must be paid to an employee. Accrued compensatory time may not exceed 240 hours. Employers must keep a record of compensatory time earned and paid. Contact the Wage and Hour Division for information on the conditions an employer must meet in order to offer compensatory time off in lieu of overtime compensation.

Equal Pay – An employer shall not discriminate on the basis of sex by paying employees a rate which is less than the rate paid to employees of the opposite sex for equal work on jobs requiring equal skill, effort, and responsibility performed under similar working conditions – except where payment is pursuant to a seniority system, merit system or system measuring earnings on the basis of quantity or quality of production or a differential other than sex.

For more information visit: https://www.michigan.gov/leo/0,5863,7-336-94422_59886—,00.html

| SOC | Description | Avg. Hourly Earnings | 2020 Jobs | Median Hourly Earnings | Median Annual Earnings |

| 51-4023 | Rolling Machine Setters, Operators, and Tenders, Metal and Plastic | $18.31 | 502 | $17.11 | $35,585.03 |

| 51-4031 | Cutting, Punching, and Press Machine Setters, Operators, and Tenders, Metal and Plastic | $16.36 | 4,117 | $16.35 | $34,013.78 |

| 51-4081 | Multiple Machine Tool Setters, Operators, and Tenders, Metal and Plastic | $17.72 | 1,083 | $17.32 | $36,016.66 |

| 51-9032 | Cutting and Slicing Machine Setters, Operators, and Tenders | $17.25 | 415 | $16.92 | $35,190.65 |

| $16.82 | 6,118 |

Insurance

Unemployment Insurance

Tax base: $9,000 Minimum rate: 0.78%, Maximum rate: 12.77%

Generally, in the first two years of a business’s liability, the tax rate is set by law at 2.7%, except for employers in the construction industry, whose rate in the first two years is that of the average employer in the construction industry, which is announced by UIA early each year.

For more information about Unemployment Insurance visit: https://www.michigan.gov/leo/0,5863,7-336-94422_97241_89981_90255-502287–,00.html

Workers’ Compensation Insurance – Michigan allows open competition among insurance carriers in setting rates, allowing Michigan companies to shop for the best prices from more than 300 insurance carriers. Actual costs will be determined by many factors, such as the selected insurance carrier, occupation code, and payroll.

Union

Manufacturing Private Sector Union Membership – Grand Rapids, Wyoming, Muskegon MSA

| Year |

% Members – Private (Percent of employed workers who are union members) |

% Covered (Percent of employed workers who are covered by a collective bargaining agreement) |

| 2009 | 13.0 % | 13.7 % |

| 2019 | 8.9 % | 8.9 % |

| Source: www.unionstats.com | ||

Michigan is a Right-To-Work State

On December 11, 2012, Michigan passed right-to-work laws, which prohibit, as a condition of obtaining or continuing employment, that an individual be required to do any of the following:

Join or support a labor organization.

Engage in, or refrain from, collective bargaining activities.

Pay dues, fees, assessments or other charges or expenses of any kind or amount or provide anything of value to a labor organization.

Pay to any charitable organization or third party any amount in lieu of or equivalent to full or partial dues, fees, assessments or other charges or expenses required of members.

Taxation

The Tax Foundation ranks Michigan’s overall business tax climate 14th in the nation for 2021.

Business Tax – Michigan levies a flat 6 percent corporate income tax on firms structured as C-corporations. Income for other business entities flows through to the owner’s personal income taxes and is taxed at a flat personal income rate of 4.25 percent.

Sales Tax – The state sales tax on tangible goods is 6 percent. No local sales taxes are allowed. Exemptions include manufacturing machinery and equipment, electricity and natural gas used in production, and pollution control equipment.

Property Tax – Michigan’s 2018 average non-homestead property tax rate was 53.06 mills, or $53.06 per $1,000 of assessed property, with real and personal property subject to taxation at 50 percent of current market value. Eligible manufacturing equipment is exempt from the personal property tax. Businesses claiming the personal property tax exemption will instead be subject to a statewide special assessment, ranging from 0.9 to 2.4 mills, to fund essential services levied by local governments. Inventory, pollution control equipment, and special tooling are exempt.

Personal Income Tax – Michigan levies a flat 4.25 percent personal income tax rate.

License & Permit

The Licenses and Permitting required vary based on the industry, location and other factors that are all project-specific. The Michigan Economic Development Corporation and Lakeshore Advantage are ready to serve as your concierge including introductions and meeting facilitation with the Michigan Department of Environment, Great Lakes, and Energy (EGLE). We have provided some links to provide a look at the resources available to help get you started.

Michigan Guide to Environmental Regulations to help businesses navigate the variety of environmental obligations they may face.

“Self-Assessment Survey” to help you identify which regulations are applicable to your specific operation.

The Air Permit to Install (PTI) is one of the regulatory requirement that are pre-construction, so it’s important to understand if you are required to apply for a PTI, and when you should do so before beginning construction (so it’s issued before you begin construction, and it fits in the company’s timeline). Currently, as of last year – 2019 – it’s averaging just under 90 days for an administratively complete PTI application to be reviewed/approved (for what we consider a minor source of air emissions). If the business is determined to be a major source of air emissions then there are federal Title V requirements (also known as a Renewable Operating Permit in the state of Michigan) that exist and EGLE has a statutory requirement of 180 days.

Business Registration Procedures / Period

State of registration – Registering a company in Michigan is easy—it takes less than one business day and Michigan has no “registered capital” requirements. However, we strongly advise that you carefully discuss your strategy with both a law firm and a tax accountant before choosing which type of entity to register.

Type of company that can be set up – Michigan law allows for the establishment of several types of companies. We would recommend consulting with a law firm to determine which type of entity best suits your company’s needs.

Utility Cost

Effective Date – Rates effective for bills issued on and after July 1, 2020.

Availability – Assigned to all Commercial and Industrial customers with a Billing Demand greater than 1000 kW any time in the preceding twelve (12) months.

Character of Service – Alternating current, 60-Hertz, single or three phase (subject to availability). The nature of the voltage is to be determined by the Holland Board of Public Works

Rates –

| Charge | Amount | Details |

| Readiness to Serve | $210.00 | Per month |

| Energy Optimization | Refer to the Energy Optimiztion Rate Schedule | |

| Delivery | $3.50 | Per kW |

| Capacity | $11.00 | Per kW |

| Energy – up to 2,500,000 kWh | $0.0490 | Per kWh |

| Energy – greater than 2,500,000 kWh | $0.0400 | Per kWh |

Adjustment for Power Factor –This rate requires a determination of the average Power Factor maintained by the customer during the billing period. Such average Power Factor shall be determined through metering of lagging Kilovar-hours and Kilowatt-hours during the billing period. Whenever the average Power Factor during the billing period is below 0.850, the bill shall be adjusted as follows:

Power Factor Adjustment:

0.800 to 0.849 1% of total kWh and kW metered-based charges

0.750 to 0.799 2% of total kWh and kW metered-based charges

0.700 to 0.749 3% of total kWh and kW metered-based charges

0.650 to 0.699 4% of total kWh and kW metered-based charges

A Power Factor less than 0.650 is not permitted and necessary corrective equipment must be installed by the customer. A 15% penalty will be applied to any metered-based charges, excluding surcharges, as long as the customer’s Power Factor remains below 0.650.

Minimum Charge is the sum of the charges listed below on all active accounts* per meter.

Readiness to Serve Charge

Delivery Charge

Capacity Charge

Energy Optimization Charge (Please refer to the Energy Optimization Schedule)

*Active accounts are services with installed meters that are available for customer use.

Transformer Ownership Discount – A customer who owns and maintains its own transformer in satisfactory condition will receive a credit of $0.45 per kW on maximum billing demand and a three (3) percent discount on all kWh during the billing period.

Delivery Charge – The kW billing demand for the delivery charge shall be the maximum fifteen (15) minute integrated rolling demand during the billing period.

Capacity Charge – The kW billing demand for the capacity charge shall be the maximum fifteen (15) minute integrated rolling demand during the on-peak hours during the billing period.

Minimum Billing Demand – The minimum billing demand used for the delivery and capacity charges shall be not less than 60% of the highest on-peak demand established during the preceding twelve (12) months.

On-Peak hours – The following schedule shall apply Monday through Friday (except holidays designated by the Holland Board of Public Works). Weekends and holidays are considered off-peak.

On-peak – 10 a.m. to 6 p.m.

Off-peak – 6 p.m. to 10 a.m.

Designated Holidays:

- New Year’s Day – January 1

- Memorial Day – Last Monday in May

- Independence Day – July 4

- Labor Day – First Monday in September

- Thanksgiving Day – fourth Thursday of November

- Christmas Day – December 25

Whenever a holiday falls on a weekend, neither the Friday nor the Monday will be considered as holidays for application of off-peak hours.

Terms and Conditions of Service – Service will be further governed by the Holland Board of Public Works Electric Service Ratebook Terms and Conditions.

Make Your Future Here.

Great people, strong community, low cost of resources and business-friendly tax structure make West Michigan a great place to do business.

Amanda Murray

Vice President of Business Solutions

Lakeshore Advantage

201 West Washington Ave. Loft 410

Zeeland, MI 49464

Office. 616.510.6982